Whether it's using a debit card to purchase a fridge, a credit card to pay for a international trip, or a mobile wallet to pay for grocery from any departmental store, digital payments are a part of every aspect of Indians' daily lives and have significantly altered our purchasing habits. In the past few years, the market has been shaped by a number of forward-thinking FinTech businesses as well as government initiatives.

Contents

Digital Payments in India

Digital payments in India are gaining momentum, according to data released by the Reserve Bank of India (RBI). Digital payment adoption continues to grow with market-led initiatives from the Government. The sector is expanding, and digital payments in India are expected to reach $1 trillion by 2026.

How Indian Government Boost Digital Payments

The Indian Government has taken several steps to boost digital payments in the country, has also offered cash backs on digital payments to incentivize consumers to use their cards more often. This, combined with other measures such as demonetization and discounts on card payments, has helped increase the number of people paying digitally compared to recent years.

The number of people using payments has grown by almost 50% over last year alone (up from 65% to 92%) and now represents nearly one-third of all banking transactions made across the country.

The Government's Digital India campaign aims to promote the country as a digitally empowered knowledge economy. The program was launched in July 2015 and has been implemented in phases.

In its first phase, the Government focused on building infrastructure for broadband connectivity, e-governance, the electronic delivery of services, and financial inclusion through digital literacy initiatives. Since then, it has moved on to developing apps and mobile phone-based solutions that citizens can use to access various services online such as booking rail tickets or applying for an Aadhaar card.

But, Hey! What are the Benefits of going Digital?

Merchants and Customers have started to experience several perks of incorporating digital payments in their day-to-day business. Some of the benefits for customers include:

Convenience:

Customers can use their smartphones to make purchases with few taps in real-time, eliminating the need to carry cash or cards.

Security:

Digital payment systems use tokenization technology, ensuring that sensitive financial information is not shared during transactions, so your money is always safe from fraudsters and hackers.

The rapid boost of the Digital payment segment can be attributed to UPI (Unified Payments Interface), which has allowed small businesses and individual merchants to take digital payments without having to pay any fee or set up additional infrastructure.

UPI (Unified Payments Interface) is a payment system that allows users to transfer funds from one bank account to another using the mobile number or virtual payment address of the recipient. It's interoperable, which means that it can be used by all banks and is fast and secure. UPI has been adopted rapidly by consumers and merchants due to its ease of use, low fees, and high-security features.

Growth of Digital Payments

Digital payments increased approximately 10X in volume between 2015 and 2020, mobile data utilization increased 24X, and m-commerce increased 2.4X. This was a big step for consumers who may not have had access previously due to a lack of bank accounts or unwillingness from merchants or service providers due to high transaction fees.

Digital payments in India are set to expand further as the Government makes it easier for people to make transactions electronically. In addition, more banks and financial institutions are offering digital payment options. As a result, we can expect the growth of digital payments to continue at an unprecedented rate.

Over 35 billion digital transactions totaling over 60 trillion Indian rupees was made in India during the fiscal year 2021. In the Indian financial year 2026, the transaction value was projected to reach over 385 trillion Indian rupees. The increased value may be related to rising smartphone adoption and escalating domestic market competition.

Most Indians will be able to make digital payments, both online and offline. It is anticipated that digital payments in India will double in the next 5 years. With the exponential development and new players coming in digital payments, a substantial part of the country’s population. Consumers and merchants will reap the benefits of digital payments and traditional banking and financial services. We anticipate India shifting from its present cash-dominated economy to one dominated by digital payments.

· · ·

Latest Report on the growth of Digital Payments in India.

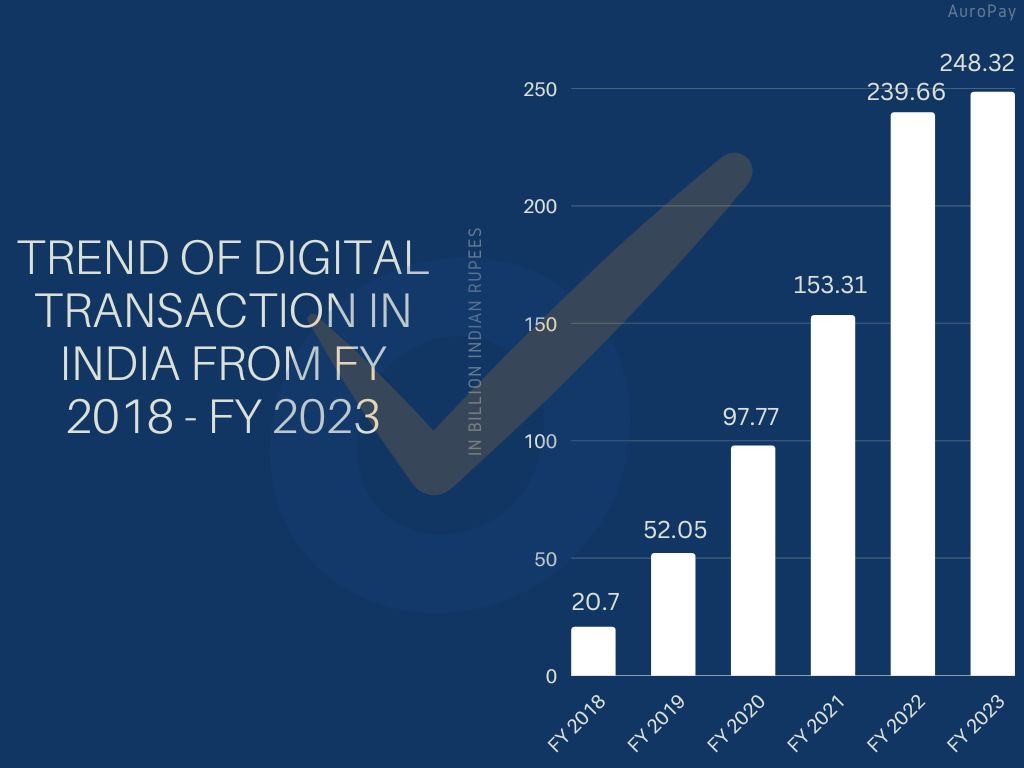

Over 239 billion rupees worth of digital payments were made in India during the 2022 fiscal year. This represents a sharp increase of 20.7 billion Indian rupees from the financial year 2018.

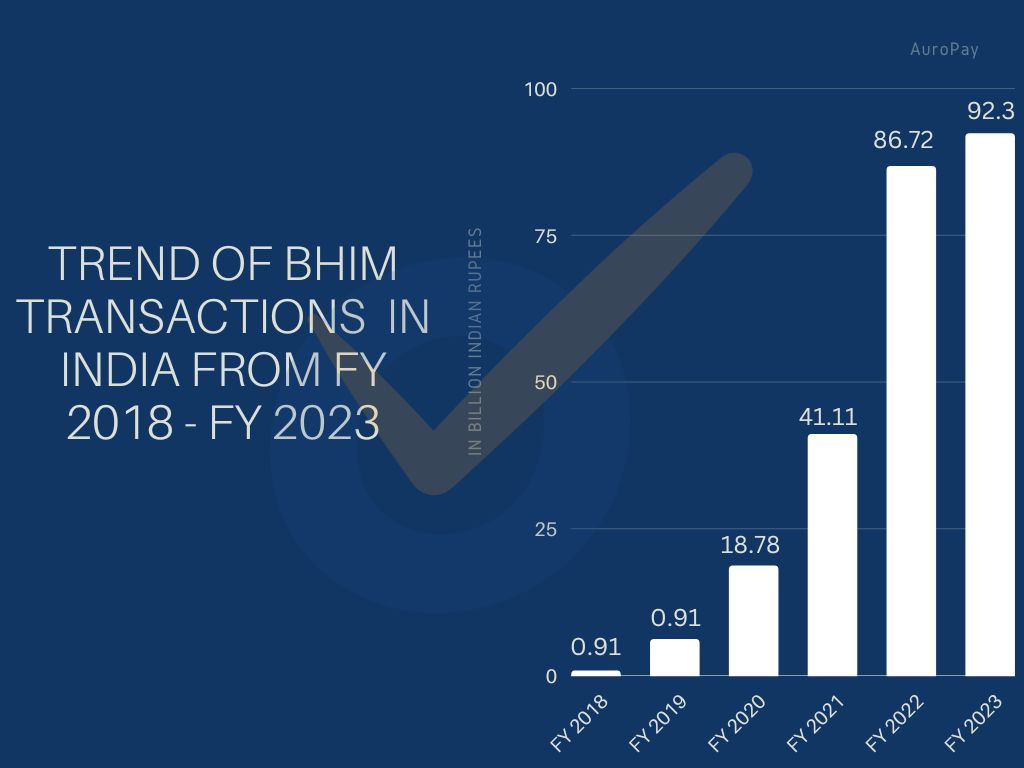

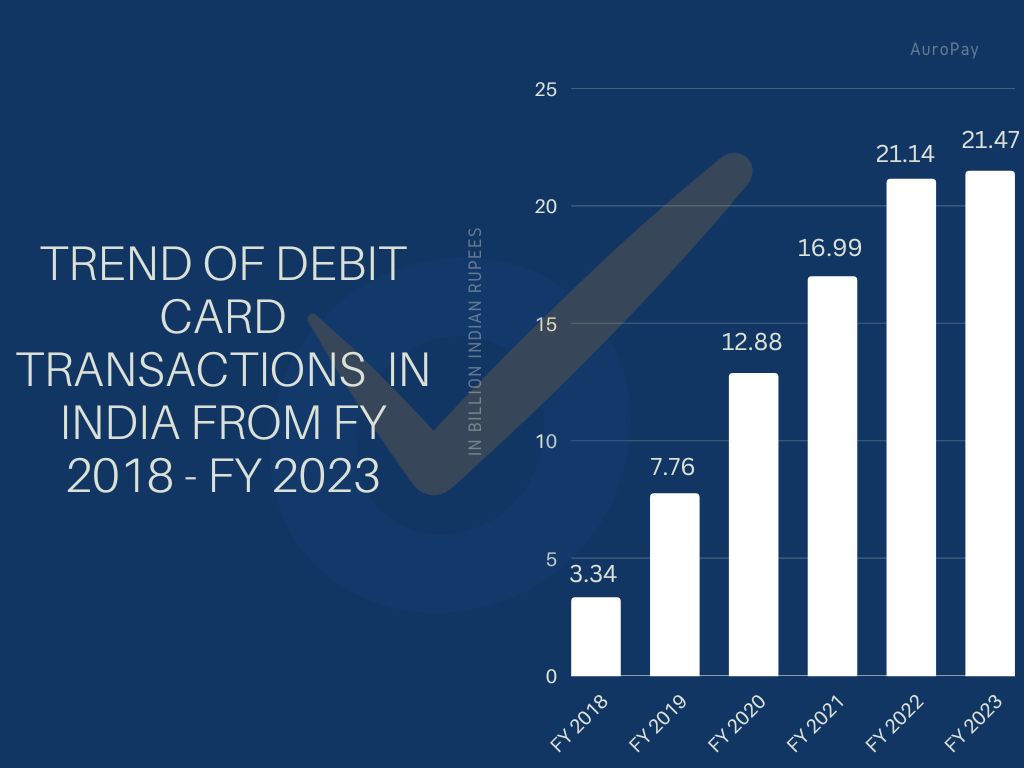

Since 2018, debit card payments have been surpassed by the mobile payment application BHIM among cashless payment methods. Debit card and BHIM transactions both saw large increases in value.

Approximately 71 billion digital payments were made in India during the 2022 fiscal year. Compared to the preceding three years, this was a huge increase. In the financial year 2022, digital payments in India, were worth approximately 84 trillion Indian rupees. From the value of almost 41 trillion rupees in the previous financial year, this represented a significant gain.

After looking at the statistics above one can understand that how rapidly the payment industry is growing and the use of cash is subsequently decreasing. The transition from cash to e-commerce & digital payments has increased the pressure on merchants in all industries to make sure their payment solutions are quick, easy, and safe. On the other hand customers also expect seamless and secure payment experience.

If you would like to learn more about secure payments read our blog ‘PCI DSS Compliance – Guarantee of complete safety’.